Investing is a topic that can seem complex and intimidating, but it doesn’t have to be. In India, mutual funds, Systematic Investment Plans (SIP), and Fixed Deposits (FD) are popular investment options that offer simplicity, flexibility, and potential returns. In this blog, we’ll break down these investment vehicles in a clear and understandable way, so you can make informed decisions about your financial future.

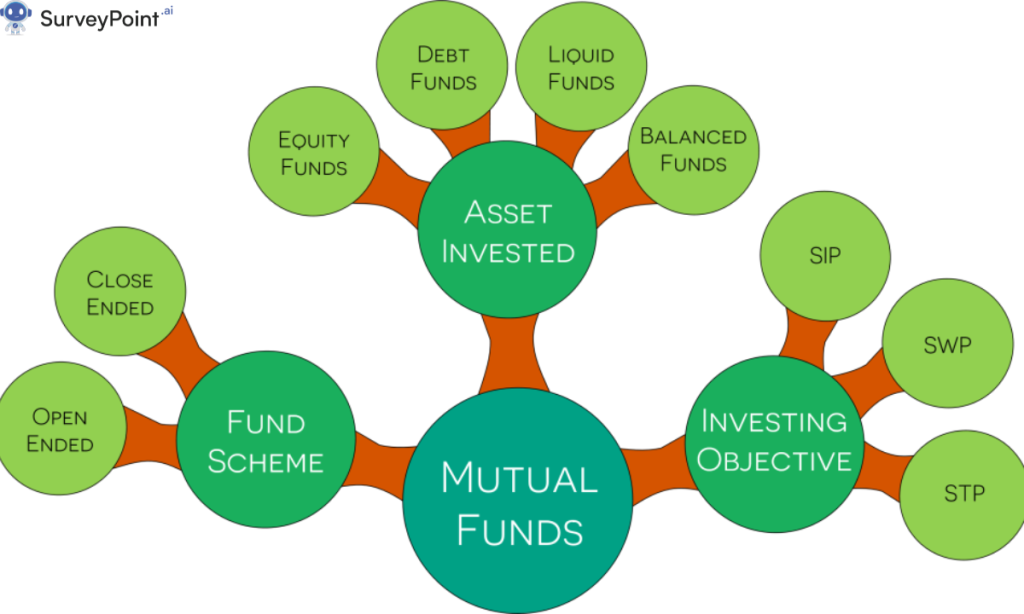

Mutual Funds: A Diversified Approach to Investing

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. This diversification helps spread risk and reduce the impact of market fluctuations on your investment. Mutual funds are managed by professional fund managers who make investment decisions on behalf of investors, based on the fund’s objectives and investment strategy.

SIP: Investing Regularly for Long-Term Growth

Systematic Investment Plan (SIP) is a disciplined investment approach that allows you to invest a fixed amount of money at regular intervals (usually monthly) in a mutual fund scheme. SIPs offer the benefit of rupee cost averaging, where you buy more units when prices are low and fewer units when prices are high. This helps mitigate the impact of market volatility and can potentially generate higher returns over the long term.

FD: A Safe and Secure Investment Option

Fixed Deposit (FD) is a low-risk investment option offered by banks and financial institutions, where you deposit a lump sum of money for a fixed period at a predetermined interest rate. FDs offer capital protection and guaranteed returns, making them a popular choice for conservative investors looking for stable income and security of principal. However, FD returns may be lower compared to mutual funds over the long term.

Choosing the Right Investment Option for You

When deciding between mutual funds SIP and FD, consider your investment goals, risk tolerance, and time horizon:

- Investment Goals: If you’re investing for long-term growth and have a higher risk tolerance, mutual funds SIP may be a better option, as they offer the potential for higher returns over time. On the other hand, if you’re looking for stability and capital preservation, FDs may be more suitable.

- Risk Tolerance: Mutual funds SIP are subject to market risk, and returns can vary depending on market conditions. If you’re comfortable with the ups and downs of the market and have a longer investment horizon, mutual funds SIP may be suitable for you. However, if you prefer a low-risk investment option with guaranteed returns, FDs may be more appropriate.

- Time Horizon: Mutual funds SIP are ideally suited for long-term investments, as they allow you to benefit from the power of compounding and rupee cost averaging. If you have a longer time horizon (typically five years or more), mutual funds SIP can help you accumulate wealth and achieve your financial goals. On the other hand, if you have short-term financial needs or prefer liquidity, FDs may be a better choice, as they offer fixed returns and easy access to funds.

Conclusion: Building a Solid Financial Foundation

In conclusion, mutual funds SIP and FDs are both viable investment options that offer simplicity, flexibility, and potential returns. Whether you choose mutual funds SIP for long-term growth or FDs for stability and security, the key is to align your investment strategy with your financial goals, risk tolerance, and time horizon. By investing wisely and staying disciplined, you can build a solid financial foundation and work towards achieving your dreams and aspirations. For more information checkout-surveypoint.ai