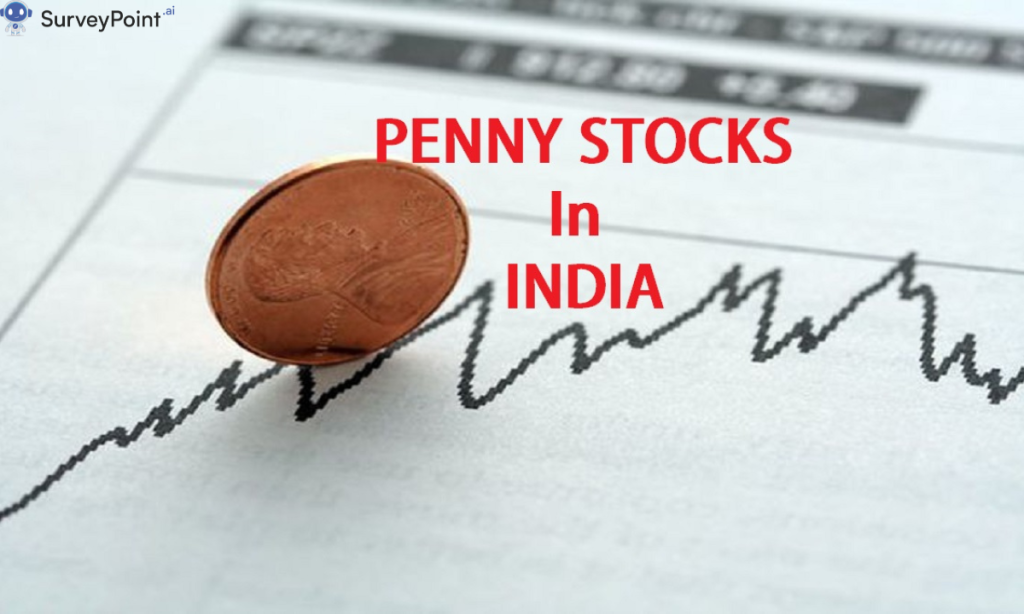

Introduction: In the dynamic world of stock market investing, there’s a constant quest for hidden gems – stocks with the potential for high returns or generous dividends. In India, two categories that often pique investors’ interest are penny stocks and high dividend stocks. In this blog, we’ll delve into these intriguing investment opportunities, uncovering their appeal, risks, and potential rewards in the Indian stock market.

Understanding Penny Stocks

Penny stocks, also known as micro-cap stocks, are shares of small companies with low market capitalization and trading at a relatively low price. While these stocks may seem enticing due to their affordability and potential for explosive growth, they also come with higher risks and volatility compared to larger, established companies. Investors interested in penny stocks should conduct thorough research and exercise caution to mitigate risks.

Potential Penny Stocks to Watch

- ITI Limited (ITI): A public sector undertaking (PSU) company, ITI Limited operates in the telecommunications sector, offering a range of products and services including telecom equipment, optical and data networking products, and internet services. With increasing government focus on digital infrastructure and the rollout of 5G technology, ITI Limited could be well-positioned for growth.

- Suzlon Energy Limited (SUZLON): Suzlon Energy is a leading renewable energy company in India, specializing in wind turbine manufacturing and wind power generation. As the world transitions towards cleaner and sustainable energy sources, Suzlon Energy could benefit from growing demand for renewable energy solutions.

Exploring High Dividend Stocks

High dividend stocks are shares of companies that consistently pay out a significant portion of their profits to shareholders in the form of dividends. These stocks are favored by income-seeking investors for their steady income streams and potential for capital appreciation. However, it’s essential to evaluate a company’s financial health, dividend history, and sustainability before investing in high dividend stocks.

Promising High Dividend Stocks in India

- Hindustan Zinc Limited (HINDZINC): Hindustan Zinc is a leading producer of zinc, lead, and silver in India, with a strong track record of profitability and dividend payments. As a subsidiary of Vedanta Limited, Hindustan Zinc benefits from the stability and resources of its parent company, making it an attractive choice for dividend-seeking investors.

- Power Finance Corporation Limited (PFC): Power Finance Corporation is a leading non-banking financial institution (NBFC) in the power sector, providing financial assistance and advisory services for various power projects in India. With a consistent track record of dividend payments and government support for the power sector, PFC offers attractive dividend yields for investors.

Conclusion: Navigating the Investment Landscape

In conclusion, penny stocks and high dividend stocks offer unique opportunities and challenges for investors in the Indian stock market. While penny stocks may offer the allure of potential high returns, they also come with higher risks and volatility. Similarly, high dividend stocks provide steady income streams but require careful evaluation of a company’s financial health and dividend sustainability.

Before investing in penny stocks or high dividend stocks, it’s essential to conduct thorough research, assess your risk tolerance, and diversify your portfolio to mitigate risks. By staying informed and disciplined in your investment approach, you can navigate the investment landscape with confidence and potentially unlock rewarding opportunities in the Indian stock market.for more information checkout- surveypoint.ai