In today’s hyper-competitive ecommerce landscape, understanding your true profitability isn’t just helpful—it’s essential for survival and growth. Yet many online retailers operate with a surprisingly limited view of their actual profit margins.

Are you confident you know the exact profitability of each product in your catalog? Can you pinpoint which marketing channels deliver the highest ROI? If you hesitated before answering, you’re not alone.

The difference between successful ecommerce businesses and those that struggle often comes down to data-driven decision making. This is where an ecommerce profit calculator becomes your secret weapon for rapid revenue growth.

In this comprehensive guide, we’ll explore how implementing a robust profit calculator can transform your ecommerce operation, helping you identify hidden revenue opportunities and eliminate profit-draining inefficiencies. From solopreneurs to enterprise ecommerce teams, these insights will help you leverage the power of profit analysis to boost your bottom line—fast.

Understanding Ecommerce Profit Calculators

What is an Ecommerce Profit Calculator?

An ecommerce profit calculator is a specialized tool designed to analyze and determine the true profitability of your online store. Unlike basic revenue tracking, a comprehensive profit calculator factors in all costs associated with your business operations.

These calculators range from simple spreadsheets to sophisticated software platforms that integrate directly with your ecommerce ecosystem. The most effective ones provide real-time data analysis, allowing you to make informed decisions quickly.

At its core, a profit calculator transforms complex financial data into actionable insights. It goes beyond just telling you what you’ve earned to reveal what you’re actually keeping after all expenses.

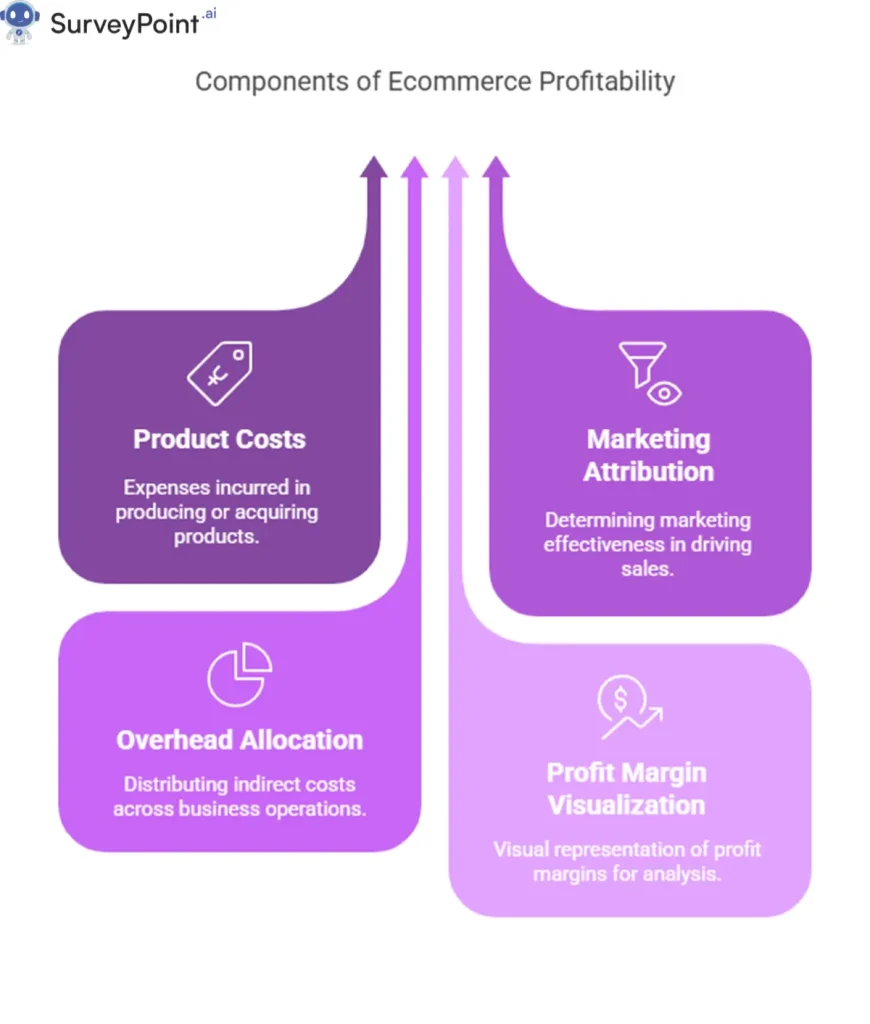

Key Components of a Profit Calculator

The most effective ecommerce profit calculators incorporate these essential elements:

Product Costs Analysis: Tracks the complete cost structure of each product, including:

- Purchase price or manufacturing costs

- Shipping and handling fees

- Packaging materials

- Import duties and taxes

- Storage costs and inventory holding expenses

Marketing Attribution: Connects marketing expenditures to specific products and channels to determine:

- Customer acquisition cost (CAC) by channel

- Return on ad spend (ROAS)

- Lifetime value to CAC ratio (LTV:CAC)

Operational Overhead Allocation: Distributes business overhead across products to show:

- Platform fees and subscription costs

- Payment processing fees

- Staff and administrative costs

- Returns and refunds impact

Profit Margin Visualization: Presents clear metrics on:

- Gross profit margin

- Net profit margin

- Contribution margin

- Break-even analysis

The power of a profit calculator lies in its ability to bring these components together into a unified view. This holistic perspective enables you to spot trends and opportunities that would otherwise remain hidden in disconnected spreadsheets or reports.

How Profit Calculators Drive Revenue Growth

Identifying Your Most Profitable Products

One of the most immediate benefits of implementing a profit calculator is gaining clarity on which products truly drive your bottom line. Many ecommerce businesses make the mistake of focusing on top-selling items without understanding their actual contribution to profit.

Consider this common scenario: Your best-selling product generates impressive revenue but carries higher-than-average shipping costs, frequent returns, and requires expensive paid advertising to maintain sales volume. Meanwhile, a modest-selling item flies under the radar despite having excellent margins, minimal returns, and strong organic traffic.

A profit calculator instantly illuminates these hidden winners in your catalog. Armed with this knowledge, you can:

- Allocate more marketing budget to high-margin products

- Feature highly profitable items more prominently in your store

- Create bundles that pair high-margin items with popular products

- Develop product lines similar to your most profitable offerings

Case in point: A home goods retailer discovered through profit analysis that their kitchen gadget category, while generating only 15% of their total revenue, contributed nearly 40% to their overall profit. By reallocating marketing spend and homepage real estate to these high-margin products, they increased overall profitability by 23% in just three months.

Optimizing Pricing Strategies

Pricing is perhaps the most powerful lever for improving profitability, yet many ecommerce businesses rely on simplistic approaches like “cost plus markup” or competitive matching.

A comprehensive profit calculator enables sophisticated pricing optimization by:

Revealing true cost-to-serve: Beyond the basic product cost, seeing the complete expense of selling each item (including shipping, handling, customer service time, and return rates) provides the foundation for intelligent pricing.

Supporting dynamic pricing tests: With accurate profit data, you can experiment with price adjustments and immediately see the impact on both sales volume and bottom-line profit.

Identifying upsell and cross-sell opportunities: Understanding product-level profitability helps you create strategic bundles and promotions that maximize customer value while preserving margins.

One specialty retailer discovered through profit analysis that their free shipping threshold was actually destroying margins on certain product categories. By adjusting their threshold based on product category and average order profitability, they increased their average profit per order by 17%.

Streamlining Operational Costs

Revenue growth isn’t the only path to increased profits. Often, the fastest route to improved financial performance is identifying and eliminating operational inefficiencies.

A comprehensive profit calculator highlights areas where operational costs are eroding your margins:

Shipping optimization: By analyzing shipping costs at the product level, you can identify items that may require different shipping strategies or pricing models.

Inventory management: Understanding the carrying costs and turnover rates of your inventory helps optimize purchasing and storage decisions.

Marketing efficiency: Seeing the true ROI of each marketing channel allows you to reallocate spending from underperforming channels to high-performing ones.

Returns handling: Tracking the full cost of returns by product category helps identify quality issues or product description improvements that can reduce return rates.

An outdoor equipment retailer used profit analysis to discover that their expedited shipping option was being underpriced for heavier items. By implementing weight-based shipping tiers, they improved their shipping margin by 12% without affecting conversion rates.

Implementing a Profit Calculator in Your Business

Choosing the Right Tool

Selecting the appropriate profit calculator for your business depends on several factors:

Business size and complexity: Smaller operations might start with template spreadsheets, while larger businesses typically need dedicated software solutions that can handle higher data volumes and more complex analyses.

Integration capabilities: The most valuable profit calculators connect directly with your ecommerce platform, payment processor, advertising accounts, and inventory management system to provide real-time data.

Reporting and visualization: Look for tools that present profit data in intuitive dashboards and allow for custom reports that answer your specific business questions.

Scalability: Choose a solution that can grow with your business, handling increasing product catalogs and transaction volumes without becoming unwieldy.

Popular options range from dedicated ecommerce analytics platforms like Glew.io and Profitwell to custom solutions built on business intelligence tools like Power BI or Tableau.

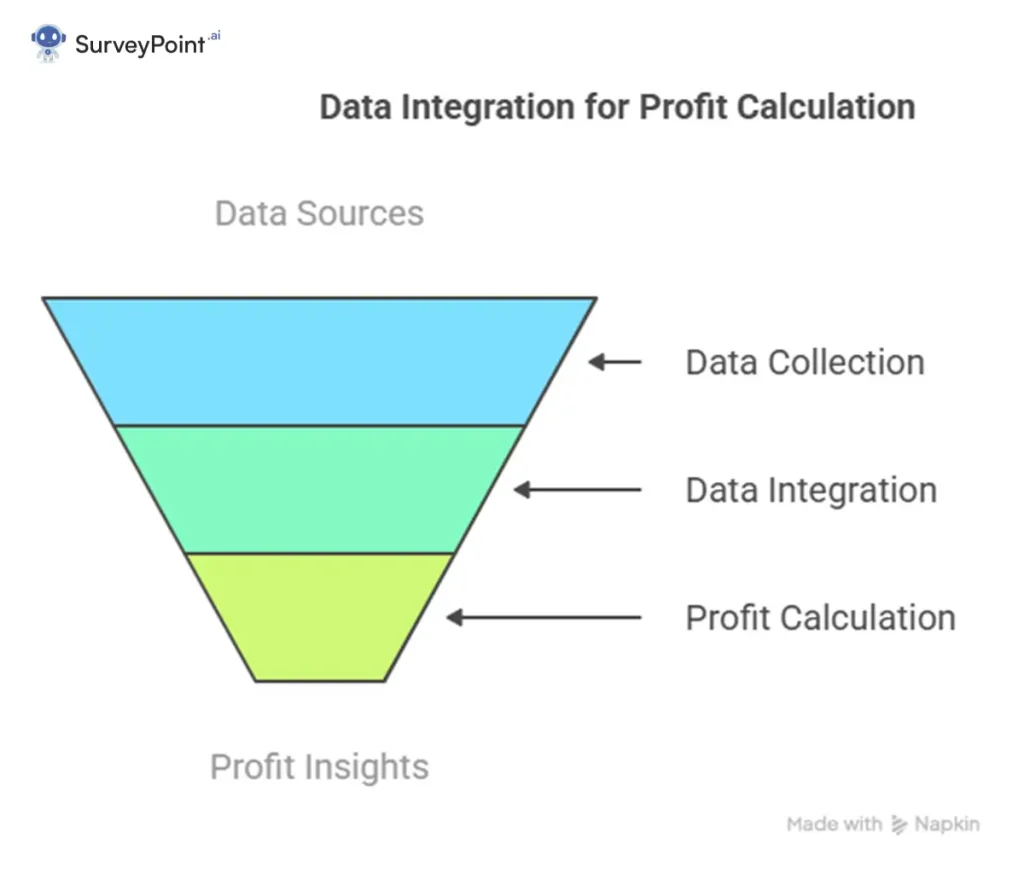

Data Integration Best Practices

The effectiveness of your profit calculator depends heavily on the quality and comprehensiveness of your data. Follow these best practices:

Consolidate data sources: Ensure your calculator pulls information from all relevant business systems, including:

- Ecommerce platform sales data

- Payment gateway fees and charges

- Shipping and fulfillment costs

- Advertising platform spending

- Inventory and product costs

- Return and refund tracking

Establish consistent data definitions: Create clear standards for how you track and categorize expenses across your business to ensure accurate profit calculations.

Implement regular data validation: Schedule periodic checks to verify that your calculator is receiving accurate and complete information from all sources.

Document assumptions: Clearly record any assumptions or allocation methods used in your profit calculations, especially for shared costs like overhead or marketing.

Training Your Team

A profit calculator is only valuable if it drives action. Ensure your team can effectively use these insights:

Executive dashboard reviews: Schedule regular reviews of profit performance metrics with leadership to inform strategic decisions.

Department-specific training: Provide tailored training for different teams:

- Marketing team: Focus on CAC, ROAS, and channel profitability metrics

- Product team: Emphasize product-level margins and portfolio analysis

- Operations team: Highlight fulfillment costs and efficiency opportunities

Decision frameworks: Develop clear guidelines for how profit data should inform common business decisions, such as:

- When to discontinue underperforming products

- Thresholds for acceptable marketing spend by channel

- Criteria for implementing pricing changes

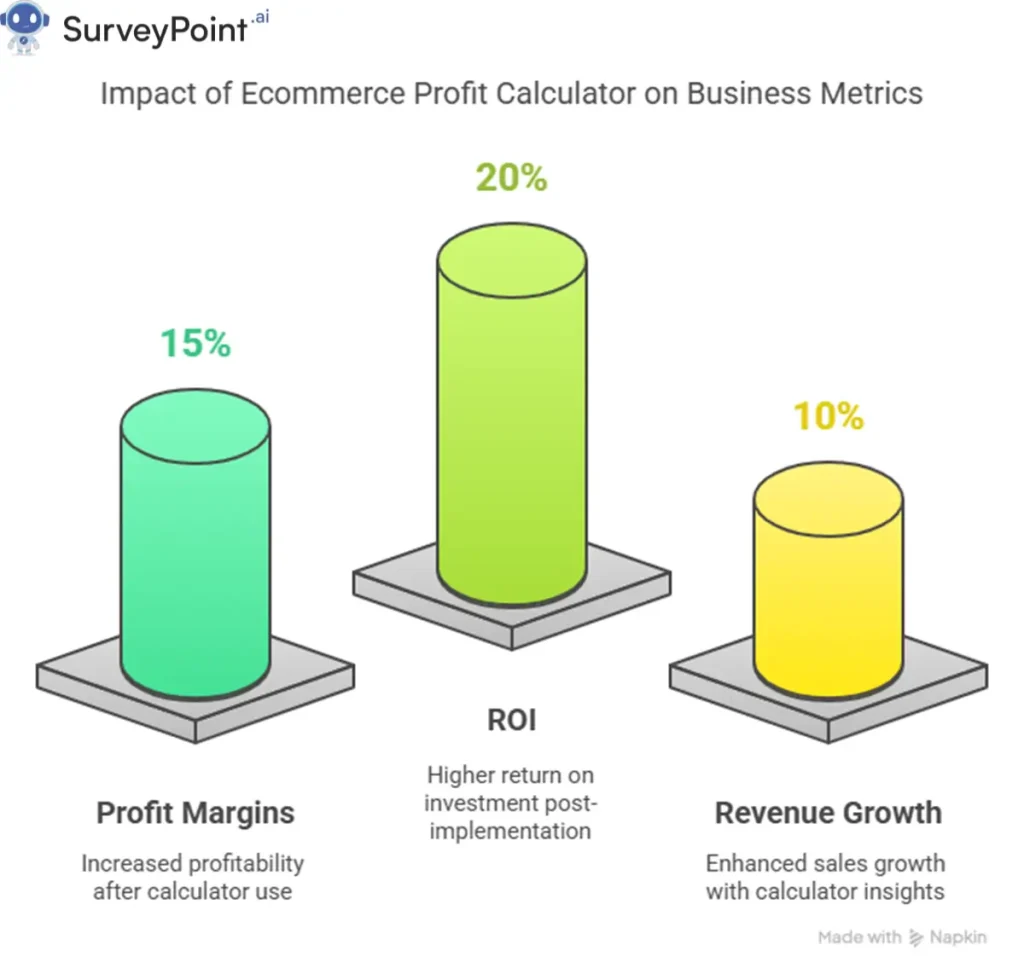

Real-World Success Stories

The impact of implementing profit calculators is best illustrated through real examples:

Beauty brand turnaround: A struggling cosmetics company discovered through profit analysis that 30% of their product catalog was actually losing money when all costs were considered. By discontinuing these products and reallocating resources to their most profitable lines, they transformed a monthly loss into a 22% profit margin within one quarter.

Subscription box optimization: A monthly subscription service used profit analysis to identify which product combinations delivered the highest customer satisfaction while maintaining healthy margins. This data-driven approach reduced their churn rate by 15% while simultaneously increasing their average profit per box.

Seasonal inventory planning: A holiday decor retailer implemented profit tracking to analyze the true performance of seasonal items. Their calculator revealed that early-season items had significantly better margins than late-season ones. By shifting their inventory investment earlier and reducing late-season stock, they increased their annual profit by 28%.

Marketing channel reallocation: An apparel brand discovered that while Google Shopping generated the most revenue, their email marketing campaigns delivered 3.5x higher profit per dollar spent. By redirecting 20% of their paid search budget to email list building and campaigns, they increased overall profitability by 31%.

Common Questions About Ecommerce Profit Calculators

How Accurate Are Ecommerce Profit Calculators?

Accuracy depends largely on the quality of your input data and the sophistication of your calculation methodology. The most reliable profit calculators incorporate all direct costs (product, shipping, transaction fees) and appropriately allocate indirect costs (marketing, overhead, support).

For maximum accuracy, update your cost data regularly and review allocation methods quarterly. While 100% precision is challenging, even a calculator that captures 90% of your true costs will provide vastly better insights than basic revenue tracking.

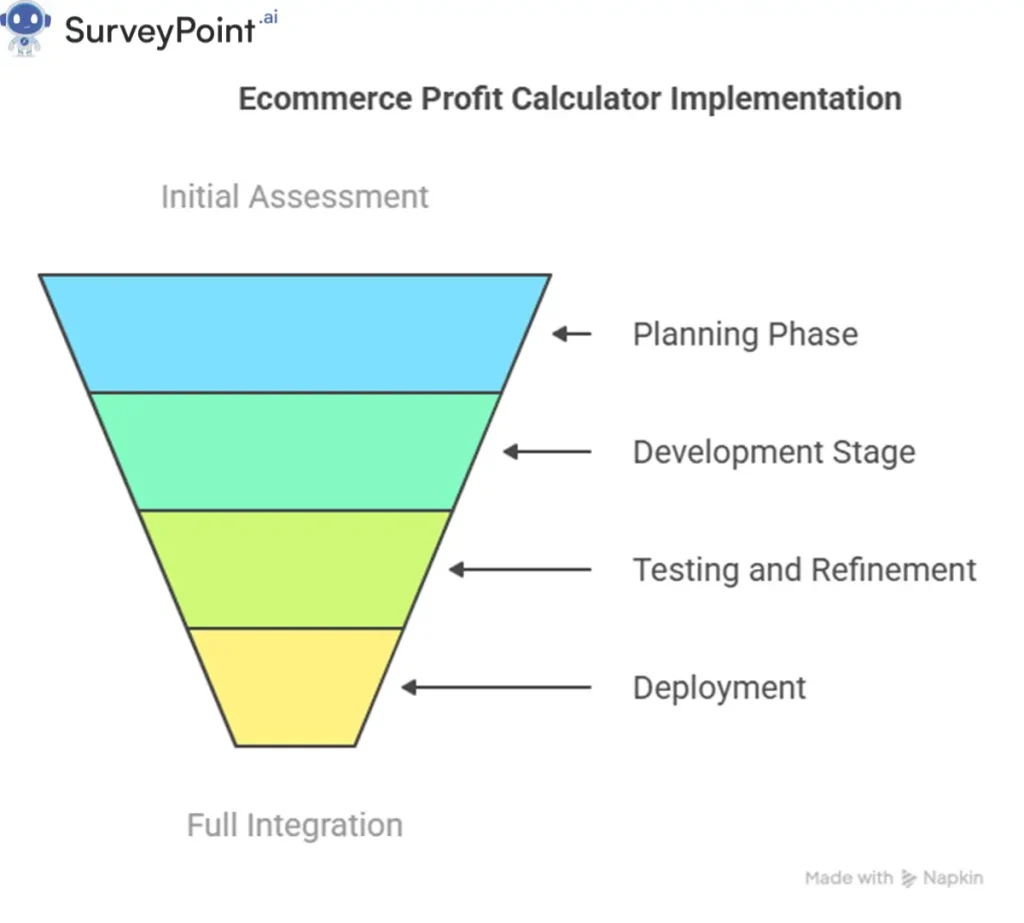

How Much Time Does It Take to Implement a Profit Calculator?

Implementation timelines vary based on business complexity and chosen solution:

- Spreadsheet-based calculators: 1-2 weeks to build and populate with historical data

- Mid-level integrated solutions: 2-4 weeks for setup and integration with data sources

- Enterprise-grade systems: 1-3 months for full implementation with custom reporting

The initial setup requires the most effort. Once established, maintenance typically requires just a few hours per week to ensure data accuracy and review insights.

Can Small Ecommerce Businesses Benefit from Profit Calculators?

Absolutely. In fact, small businesses often see the most dramatic benefits, as they typically operate with thinner margins and less room for error. A simple spreadsheet-based calculator can provide tremendous value for small operations.

For solopreneurs and micro-businesses, even basic profit analysis can prevent costly mistakes like investing in marketing channels that don’t deliver profitable customers or expanding product lines that seem successful but actually drain resources.

How Often Should I Update My Profit Calculations?

Ideally, your profit calculator should update in real-time or at least daily for most metrics. This frequency allows you to quickly identify and address issues like:

- Sudden increases in advertising costs

- Changes in shipping rates or product costs

- Seasonal fluctuations in return rates

- Unexpected platform fee adjustments

At minimum, conduct a comprehensive profit analysis monthly, with quarterly deep-dives to reassess allocation methods and test assumptions.

What’s the Difference Between a Revenue Calculator and a Profit Calculator?

This distinction is crucial. A revenue calculator simply shows your incoming sales, while a profit calculator subtracts all associated costs to reveal your actual earnings.

Revenue calculators can be misleading because they might show growth while your business is actually becoming less profitable due to increasing costs. A proper profit calculator provides the complete financial picture needed for sustainable business decisions.

Taking Action: Your Next Steps

Ready to leverage the power of profit analysis in your ecommerce business? Follow this implementation roadmap:

1. Assess your current profit visibility Start by evaluating your existing financial tracking. Can you confidently state the profit margin of every product? Do you know your customer acquisition cost by channel? Identifying these gaps will help define your calculator requirements.

2. Conduct a pilot analysis Before implementing a full-scale solution, perform a manual profit analysis on your top 20% of products. This exercise will often reveal immediate opportunities and build momentum for a more comprehensive approach.

3. Select and implement your calculator solution Based on your business needs and technical capabilities, choose the appropriate tool—from custom spreadsheets to dedicated software. Focus on getting clean data connections established.

4. Establish a review cadence Create a regular schedule for reviewing profit insights at different levels:

- Daily: Quick check of key metrics and anomalies

- Weekly: Channel and product category performance

- Monthly: Comprehensive business review and action planning

- Quarterly: Strategic assessment and calculator refinement

5. Create feedback loops Ensure that insights from your profit calculator inform decisions across the business:

- Product development and sourcing

- Marketing budget allocation

- Pricing strategies

- Inventory planning

- Promotion scheduling

Conclusion

In today’s margin-conscious ecommerce environment, implementing a comprehensive profit calculator isn’t just an accounting exercise—it’s a strategic imperative that directly impacts your bottom line.

The businesses that thrive in increasingly competitive markets are those that understand their true profitability at a granular level and use those insights to make informed decisions. A well-implemented profit calculator provides exactly this visibility.

From optimizing your product mix and marketing spend to refining operational processes and pricing strategies, profit analysis empowers you to focus your limited resources where they’ll generate the greatest returns.

The most successful ecommerce entrepreneurs and managers recognize that revenue growth alone doesn’t guarantee business success. By embracing profit-centric analysis, you position your business not just for growth, but for sustainable, profitable growth that builds long-term value.

Start today with even a simple profit calculator, and you’ll likely discover opportunities to boost your bottom line that have been hiding in plain sight. The competitive advantage gained from this financial clarity can be the difference between struggling to keep up and leading your market.