Payment methods are gaining popularity with the masses as they are quick, safe, and dependable. This is because of payment gateways. They make it simple and fast for buyers to make payments online. We’ve reviewed a number of payment gateways to provide you with a list of payment gateways that suits your company’s needs.

Payment Gateway: What is it?

A payment gateway enables online businesses to accept electronic customer payments through a software application. Between the customer’s bank and the merchant’s bank is that there is a transaction that takes place by securely transmitting the payment information.

Online businesses can thrive, given that payment gateways are in place, as they ensure that the payments take place securely and quickly.

How Does a Payment Gateway Work?

After a consumer purchase on an e-commerce website, the payment gateway page opens.

The payment gateway takes in the payment information and sends it to the payment processor. The payment processor then sends the payment request for authorization to the customer’s bank.

Finally, when the payment is authorized, the processor sends a confirmation to the gateway, which then sends a confirmation to the e-commerce website.

ALSO READ: Make Your Online Payments Easier With These Venmo Alternatives

Types of Payment Gateways

There are two main types of payment gateways:

Hosted Payment Gateways

Hosted payment gateways redirect customers to the payment gateway’s website to complete the payment process. Since this type of payment gateway is easy to set up and does not require much technical knowledge, it is popular among small businesses and startups.

Integrated Payment Gateways

Integrated payment gateways allow customers to complete the payment process without leaving the e-commerce website. This type of payment gateway is more complex and requires technical expertise to set up.

List of Payment Gateways

Here are the top payment gateways available in the market:

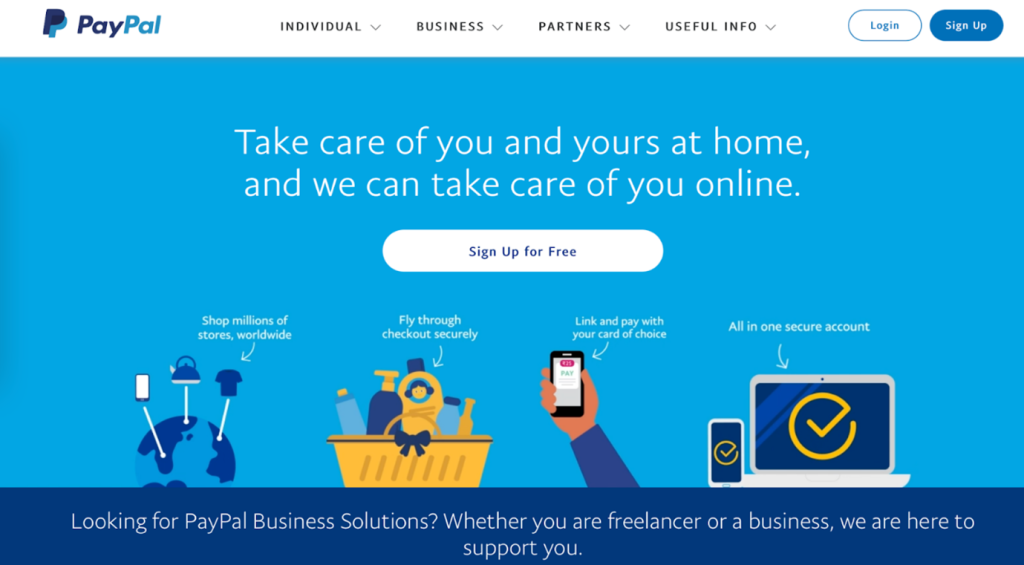

PayPal

One of the most popular payment gateways is PayPal. It offers both hosted and integrated payment gateways and supports over 100 currencies. Millions of customers worldwide trust PayPal, which is easy to set up.

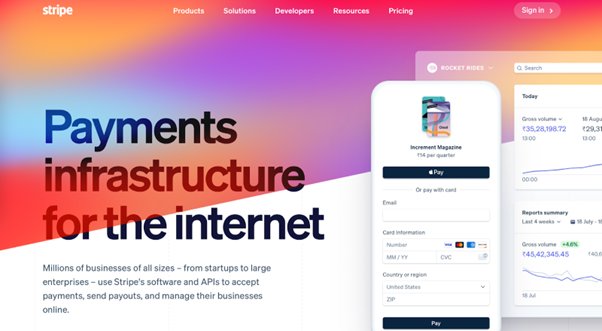

Stripe

Stripe is a popular integrated payment gateway that offers a simple and user-friendly interface. In fact, it supports multiple payment methods and is known for its excellent customer support.

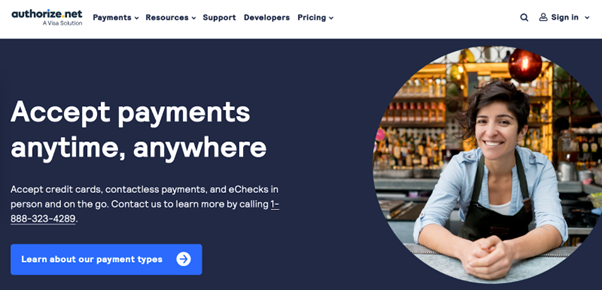

Authorize.Net

Popular payment gateway Authorize.Net provides hosted and integrated payment gateways. It offers a range of payment methods, including credit cards, e-checks, and PayPal. Authorize.Net is known due to its robust security features.

Square

- Square is a payment gateway that is popular among small businesses. Several payment options are accepted, including Apple Pay and credit cards.

- Well-known for its user-friendly design and reasonable costs.

Braintree

- Braintree is a payment gateway that is popular among larger businesses. Therefore, the company accepts a variety of payment methods, including credit cards, PayPal, and Apple Pay.

- Known for its excellent fraud protection features, Braintree offers a wide range of services.

Verifone

Multiple payment options are available with Verifone, including recurring billing and fraud detection.

Payline

Payline is a payment gateway offers a range of features, including mobile payments, recurring billing, and fraud detection.

BlueSnap

Similar to other payment gateways, BlueSnap provides a number of capabilities, such as recurring billing, global payment processing, and fraud detection.

Worldpay

Worldpay is a payment gateway offering various features, including mobile payments, recurring billing, and fraud detection.

Choosing from the List of Payment Gateways

When choosing a payment gateway, there are several factors to consider, including:

Security

Security should be your top priority when choosing a payment gateway. Look for payment gateways with robust security features like PCI compliance and fraud protection.

Cost

Cost is equally important when selecting a payment gateway. For that reason, different payment gateways have different pricing models. Look for payment gateways that offer transparent pricing and don’t charge hidden fees.

Customer Support

Look for payment gateways that offer excellent customer support. To emphasize, if you encounter any issues with the payment gateway, it is vital to address them promptly.

ALSO READ: Paypal vs Venmo: Which One’s More Advanced?

Conclusion

Your e-commerce business’s success depends on selecting the appropriate payment gateway. For this purpose, we reviewed everything you need to know about payment gateways, including the top payment gateways available in the market.

When choosing a payment gateway, consider security, cost and customer support. By choosing the right payment gateway for your business, you can add revenue and ensure a smooth payment experience for your customers.

FAQs

Q1. How do a payment gateway and a payment processor differ from one another?

In payment gateways, the merchant and customer’s banks communicate through software. On the other hand, when a company processes the payment on behalf of the merchant, a payment processor.

Q2. Do I need a payment gateway for my e-commerce website?

Yes, in any event, a payment gateway is essential for any e-commerce website that wants to accept electronic payments.

Q3. For my website, how can I set up a payment gateway?

You can set up a payment gateway by choosing a provider and following their setup instructions.

Q4. Are payment gateways secure?

Yes, payment gateways are secure. Look for payment gateways with robust security features such as PCI compliance and fraud protection.

Q5. Can I use multiple payment gateways on my website?

Absolutely, your website can use numerous payment gateways. However, it may be more complicated to set up and manage.

Not Sure Where To Begin?

Explore our solutions to discover what is most important to your customers,

clients, and prospects. And best of all – it doesn’t take any coding!

Free Trial • No Payment Details Required • Cancel Anytime