Who doesn’t shop online?

E-commerce platforms such as Amazon, Flipkart, Meesho, and Myntra offer you countless items at the best prices, all at your fingertips.

And thanks to the pandemic and the introduction of 4G in India, the masses have formed an unbreakable bond with such apps. In fact, you can even think of online shopping as an integral part of an individual’s life.

Don’t believe it?

The number of Indian internet shoppers is expected to hit $500 million by 2030, according to a report by Inc 42. At the moment, it’s somewhere around 230 million.

And e-commerce companies stand to benefit the most from it. To keep the momentum going, fintech companies are also doing their bit.

And Buy Now, Pay Later (BNPL) is one such latest innovation.

In BNPL, a particular entity offers to pay on your behalf. And then, you pay back the company the exact amount over a period of months with no interest.

Sounds great, right? Well, we Indians certainly think so.

According to a consultancy firm, RedSeer, the BNPL market in India is currently estimated at around $3.2 Billion. It is expected to reach $40-50 billion by 2026. As the online shoppers count increases, so will the number of consumers who use BNPL.

The company forecasts that by 2026, between 80 and 100 million people throughout the country will be using BNPL.

But what’s all this hype about? Let’s understand the concept of BNPL.

What is BNPL?

As the name suggests, BNPL is a short-term financing option that allows consumers to make an online purchase instantly and pay later.

When the buyer makes a purchase, a BNPL service provider pays the full amount on behalf of the buyer. Over a few weeks or months, the buyer will pay back the service provider the agreed upon sum with minimal or no interest added.

This makes BNPL an excellent alternative to a credit card, as a majority of the Indian population does not own a credit card. BNPL has no hidden charges, extra fees, or interest. Thus you know the exact amount of your payments, making it simple, convenient, and transparent.

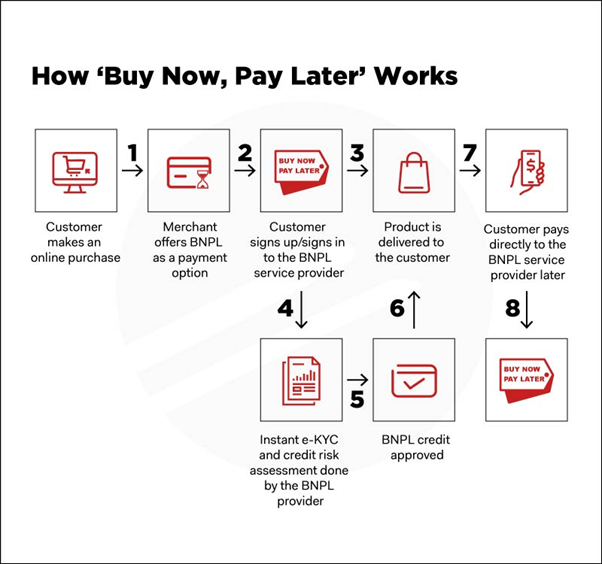

How Does BNPL Work?

BNPL works in the following way:

- Before buying an item, you must sign up with a BNPL service provider. You can then use the service provider’s app to make the purchase.

- Not all retailers support the same BNPL service provider, so make sure the respective e-commerce platform supports your service provider.

- During checkout, use the ‘BNPL’ option. If your purchase gets approved, you’ll have to make a small down payment (about 25-30% of the purchase price).

- Once approved, you can choose to pay off the remaining sum either as a lump sum or as interest-free EMIs.

The remaining payments will be directly deducted from your credit or debit card, online wallet, or bank account. Depending on your purchase amount, you can choose from three options (options may vary from country to country):

- Pay Later: Pay the entire amount after 30 days.

- Pay Later Installments: Pay the amount in interest-free installments

- Finance It: Pay the amount in as many as 36 monthly installments with some interest

Also Read: Venmo VS Cash App: Which One’s Better?

Benefits Of BNPL

The popularity of BNPL among Indian consumers shows no signs of abating. Businesses and stores can reap its benefits, but only if they fully grasp its foundation.

BNPL offers the following benefits to consumers:

- A simple, convenient, and transparent payment process

- Buyers don’t need a credit card to use BNPL

- Buyers don’t need to maintain any credit score to use BNPL

- The option to pay with zero-interest EMI

- Instant credit approval

- Allows buyers to choose their repayment duration

- The interest rate (if applicable) is lower than that of credit cards

You Might Also Like: How Buy Now, Pay Later is Redefining Online Shopping?

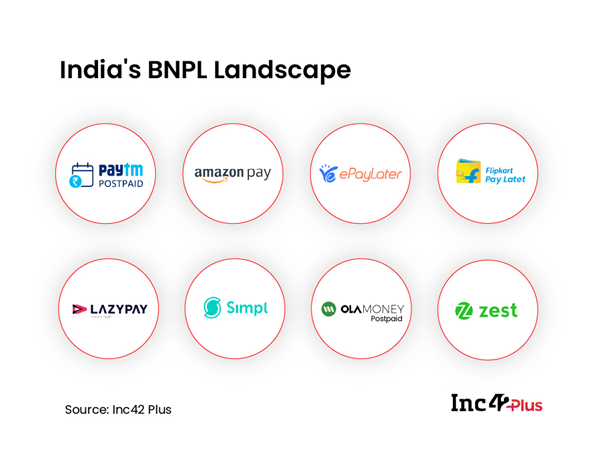

Major BNPL Service Providers in India

Here are some of the major BNPL players in the Indian market:

- Paytm Postpaid

- Ola Money Postpaid and Wallet

- Amazon Pay Later

- Flipkart Pay Later

- LazyPay

- ZestMoney

- Simpl

- ePayLater

You Might Also Be Interested In: Paypal vs Venmo.

To Buy Or Not To Buy?

Sushant Bindal, CEO of Money Monitors, has stated that BNPL is not a good investment for people who cannot pay the costs associated with it because these people have a tendency to overspend their money.

BNPL provides people with a false sense of hope that they can afford certain things when in reality, they cannot.

BNPL does not require you to maintain a credit score. This might backfire on you as some BNPL providers can pass on your missed payment details to the bank, affecting your credit score.

While late payments will set back your credit score, on-time payments will boost your creditworthiness. However, you should be aware of BNPL loans, as most of them result from impulse buying and not planned purchases.

In conclusion, it’s not recommended to use BNPL unless you can afford to pay for it in full right away. However, if you’re in a certain make-or-break situation, it wouldn’t hurt to use it as long as you repay it on time.

Use BNPL only if absolutely necessary.

Wrapping Up

There’s no ignoring that BNPL has forever changed how consumers shop online and perceive online payments.

Thanks to BNPL, online payments are faster, simpler, and much more transparent. It has led to a dynamic power shift. Banks and credit cards had the monopoly for years, but not anymore.

BNPL has done the impossible by stealing customers from banks and credit card companies. All it did was provide buyers with a flexible and alternative option to make payments over time with little to no interest rate.

Despite its fascinating features, you cannot turn a blind eye to its potential drawbacks. Due to the fact that BNPL is just getting started and still has a ways to go, those are to be expected.

If you’re considering trying on BNPL, just ensure you understand the terms and conditions. Also, keep an eye on whether you can make the payments on time. If not, be ready to face the penalties.

And remember to save and invest for a better financial future!